Gender equality has become a necessity in today’s business climate. Women from all walks of life are now welcomed with open arms into the MSME sector, which was once overcrowded with businessmen. The introduction of several government incentives for women entrepreneurs in India has encouraged more women to take the plunge. Programs from both the state and federal governments are included.

Women have an important part in the overall growth of the MSME sector.

As a result of their expanding presence, women entrepreneurs have had a huge impact on India’s social and economic demographics. Women’s engagement in the labour force has benefited millions of families by resulting in the creation of jobs.

MSMEs are India’s economic backbone, employing millions of men and women across the country. In India, however, women make up only 13.76 percent of all entrepreneurs. Despite the fact that the number of men entrepreneurs has topped 50 million, there are only roughly 8 million female entrepreneurs.

Women entrepreneurs are progressively establishing themselves as a force to be reckoned with in the business world, and they are doing so not merely to survive, but also to satisfy their inner drive for creativity and to demonstrate their abilities. Educated women contribute significantly to society development, and in the future, more women will enter previously male-dominated fields.

How Government and banks are encouraging women to start their business

Indian women have gone a long way from being financially reliant on men. Women are self-sufficient today. They are financially accountable for themselves and make their own financial decisions. A number of government and bank initiatives are also geared specifically at boosting women’s financial independence.

Benefits of Savings Accounts

In addition to standard savings accounts, banks allow women to save money in specially specialized savings accounts. These savings accounts fully satisfy the financial and investment objectives of today’s Indian women, and they offer competitive features in accordance with contemporary lifestyle expectations.

Loan Benefits

Women can get house loans at cheaper interest rates from a number of major institutions. If the woman is the initial candidate for a shared house loan, banks may give discounted loan rates. Furthermore, when compared to their male counterparts, women receive lower interest rates on car loans. If the rate of interest remains constant during the loan term, women can save more. This is especially true when a family takes out a substantial loan with the help of a female applicant. Aside from low-interest rates, some banks also exempt women from paying loan processing fees.

Government Schemes

Several government programs for women entrepreneurs have also been developed. The Bhartiya Mahila Bank (BMB) business lending scheme, for example, is aimed towards women who want to start their own company. The Annapurna Scheme is another government-sponsored financial program for women. The program’s goal is to help women start a catering business by providing financial assistance. Aside from these two well-known programs, the government has introduced a number of other financial initiatives to encourage women to become entrepreneurs in the country. We will discuss more about these schemes below.

Prominent Government Schemes that can give wings to Women Entrepreneurs

For these female MSMEs owners, the government around the country are offering enticing incentives to support their businesses and make it easier for them to obtain financing.

Pradhan Mantri Mudra Yojana

Under this central government scheme, women entrepreneurs can get loans ranging from Rs 50,000 to Rs 10 lakh with simple payback terms. It is administered by the Micro Units Development and Refinance Agency (MUDRA) and provides loans to enterprises in the manufacturing, trading, and service sectors.

Also Read : 8 Smart Google Maps’ Hacks to use during your Next Trip

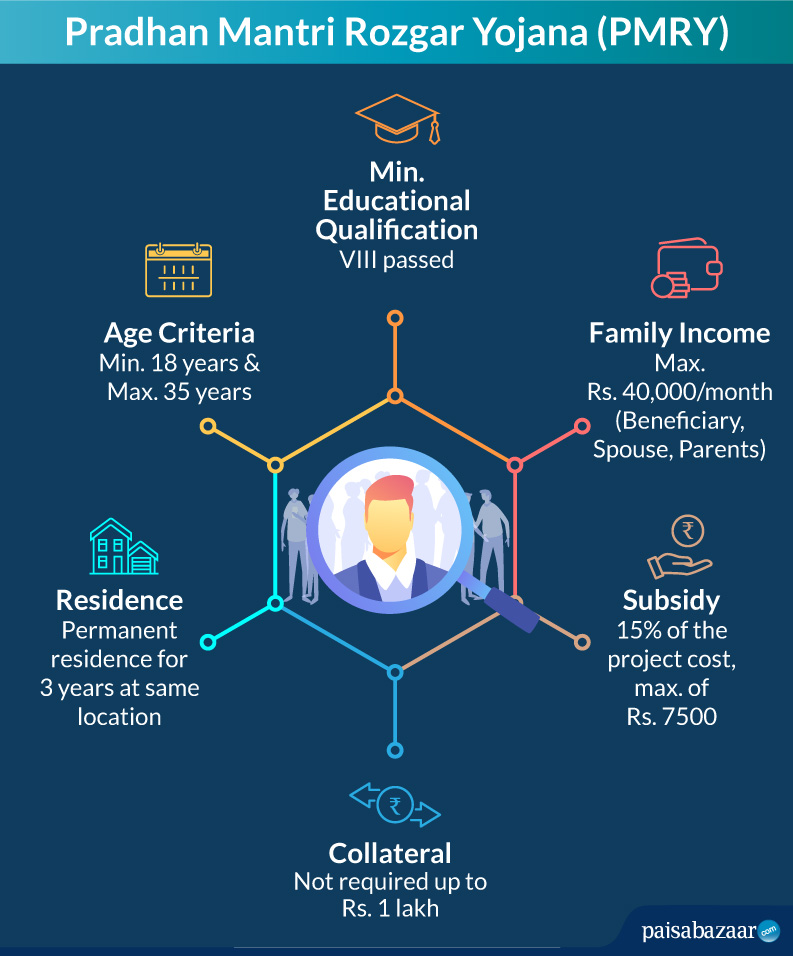

Pradhan Mantri Rozgar Yojana

Women entrepreneurs can receive financial assistance under this scheme and grow their business. Women in all industries, new businesses, and services will benefit from this program. This program primarily focuses on empowering women by providing loans to help them become financially self-sufficient. Agriculture is included in the system, which also envelops all business alternatives. The most important feature of this scheme is that it offers a 15% discount on project costs, up to a maximum of INR12500 per person.

Trade Related Entrepreneurship Assistance and Development (TREAD) Scheme

This program strives to empower women by lending money to initiatives, giving specialized training and counselling, and gathering information on relevant needs. The scheme allows the government to provide a grant of up to 30% of the overall project cost, as determined by financial institutions. The remaining 70% would be financed by these institutions.

Annapurna Yojana

Many women are fantastic cooks and may make money by starting a catering business. This Indian government program for female entrepreneurs intends to assist women who want to launch a catering business. Women can borrow up to Rs 50,000 under the Annapurna scheme. This loan has a 36-month repayment period and requires collateral and a guarantor for acceptance. Assets are used as collateral for Annapurna program loans.

Udyogini Scheme

This program is ideal for ladies who want to establish their own business but don’t know where to begin. The GOI intends this scheme for women who belong to a family that earns less than INR 1.5 lakhs per year, with no discrimination against widowed, poor, or disabled women. The scheme provides up to Rs 3 lakh in cash, with a low-interest rate. The goal is to assist women in becoming self-sufficient by creating their own enterprises, particularly in economically underdeveloped countries. Through loan subsidies, women can embark on a path of business.

Cent Kalyani Scheme

This plan channeling MSME loans for new businesses will be extremely advantageous to women who work in MSMEs. This program is for women who run or want to start a small business. The Central Bank of India is credited with initiating this scheme, which is known as the Cent Kalyani Scheme. Other women who benefit from this program are those who work in agriculture or in retail. This scheme offers loans ranging from Rs 1 crore with no collateral or guarantors necessary. In addition, the Cent Kalyani Scheme’s business loan interest rate is determined by market conditions.

Bottom line

Financially independent women can contribute to society’s faster growth and progress. As a result, the Indian government has established efforts to provide credit to women, who can then use it to achieve their business objectives. Resultantly, they will be able to expand and provide more jobs for women.

Source: MSMEX

Further Readings