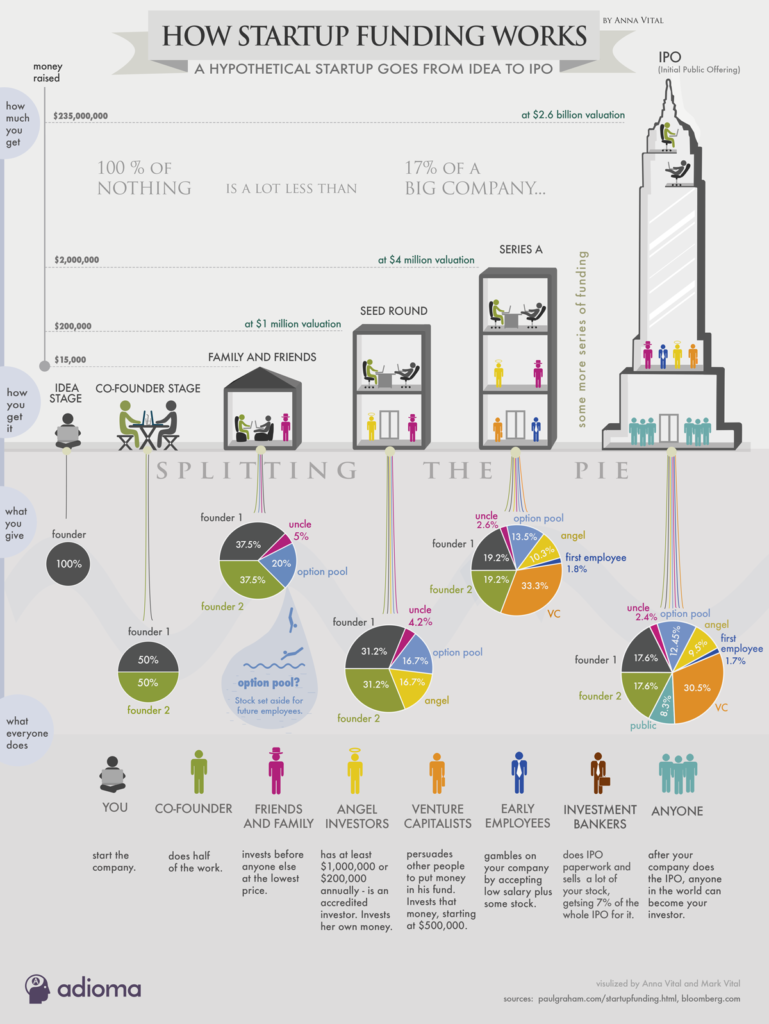

A startup with an excellent company concept wants to set up its operations. Due to the generosity of friends, family, and the founders’ own financial resources, the company has grown slowly from its modest beginnings while demonstrating the value of its model and goods. With time, the company’s clientele expands, and its operations and goals grow as well. Within a short period of time, the business has risen through the ranks of its rivals to achieve high valuation, creating opportunities for future expansion to add new facilities, personnel, and perhaps an initial public offering (IPO). Early on in the hypothetical business described above, if it seems too good to be true, it probably is. The vast majority of successful startups have made numerous attempts to raise money through rounds of external fundraising, even while there are a very tiny number of fortunate businesses that expand in accordance with the strategy mentioned above (and with little to no “outside” support”). These funding rounds give outside investors the chance to contribute money to a developing business in exchange for equity, or a share of the business. Series A, Series B, and Series C funding rounds are phrases used to describe the process of a company expanding through outside investment.

Depending on the sector and the level of investor interest, businesses may be eligible for additional funding rounds. Startups frequently receive “seed” capital or angel investor money at the beginning of their operations. Following these funding rounds, Series A, B, and C funding rounds as well as other efforts to raise money may be made, as necessary. For a firm to realize that bootstrapping—or simply surviving off of the goodwill of friends, family, and the depth of their own pockets—won’t cut it, Series A, B, and C are vital components.

We’ll look more closely at these funding rounds below, including what they are, how they operate, and how they differ from one another. Each startup’s journey and funding timeframe are a little bit different. While many businesses spend months or even years looking for funding, others—especially those with concepts that are considered truly revolutionary or those associated with people who have a track record of success—might skip some of the rounds of funding and proceed directly to the capitol-building stage.

We’ll look more closely at these funding rounds below, including what they are, how they operate, and how they differ from one another. Each startup’s journey and funding timeframe are a little bit different. While many businesses spend months or even years looking for funding, others—especially those with concepts that are considered truly revolutionary or those associated with people who have a track record of success—might skip some of the rounds of funding and proceed directly to the capitol-building stage.

By appreciating the context of what precisely a round signifies for the prospects and direction of a firm, it will be simpler to interpret headlines regarding the startup and investing sector once you are aware of the differences between these rounds. Series A, B, and C fundraising rounds are only first steps in the process of developing a brilliant idea into a ground-breaking international business ready for an IPO.

Working of Funding

Identifying the various participants is crucial before examining how a round of funding functions. First, there are those who want to raise money for their business. It is typical for a firm to start with a seed round and then go through funding rounds A, B, and eventually C as it gets more established.

Potential investors are on the other side. Investors support entrepreneurship and believe in the goals and reasons of those enterprises, thus they want those businesses to flourish. However, they also want to get a return on their investment.

Due to this, almost all investments made at a particular stage of developmental funding are set up so that the investor or investing business keeps a portion of the company’s ownership. The investor will receive a return on their investment if the business prospers and makes a profit.

Analysts do a valuation of the company in question prior to the start of any round of fundraising. The management, track record, market size, risk, and a variety of other characteristics are used to determine valuations. The valuation of the business, together with its maturity level and growth possibilities, is one of the fundamental differences between investment rounds. These variables then have an effect on the types of investors who are likely to participate and the potential reasons for a company’s need for further funding.

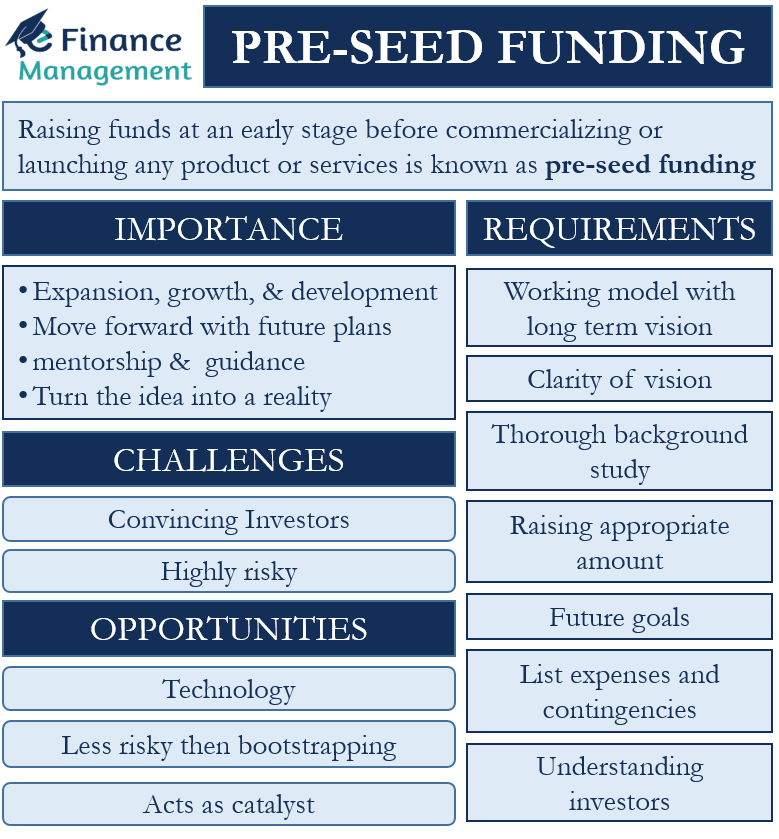

Pre Seed Funding

The initial round of investment for a new business occurs so early in the process that it is typically excluded from all subsequent rounds of funding. This stage, often known as “pre-seed” funding, usually describes the time when a company’s founders are just starting to run their business. The founders themselves, as well as close friends, backers, and family, are the most typical “pre-seed” funders. This funding stage may go extremely fast or may take a very long time, depending on the company’s nature and the initial expenses associated with establishing the business idea. Additionally, it’s likely that at this point, investors are not contributing money in exchange for firm shares.

In a pre-seed funding scenario, the company founders themselves are typically the investors.

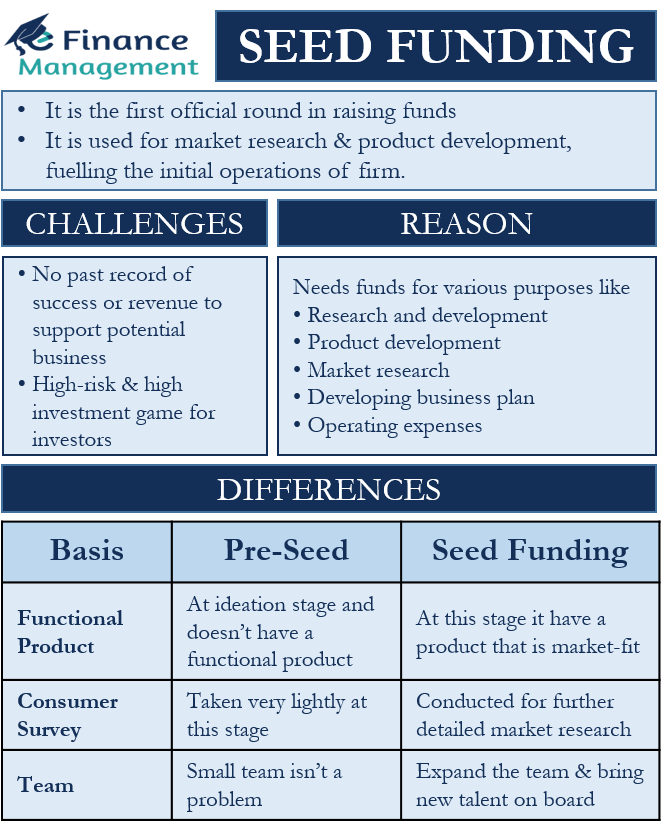

Seed Funding

The initial step of formal equity fundraising is called seed funding. It usually denotes the initial formal funding that a firm or enterprise raises. Some businesses never raise Series A or higher rounds of funding after receiving seed money.

A company can use seed money to finance its initial initiatives, such as product development and market research. With seed money, a business might acquire help figuring out what its end products will be and who its target market is. A founding team is hired with seed money to carry out these duties.

In a seed fundraising scenario, there are numerous prospective investors: entrepreneurs, friends, family, incubators, venture capital firms, and more. A so-called “angel investor” is one of the most popular sorts of investors who participate in seed investment. Angel investors typically prefer riskier endeavors (such as startups with a scant prior track record) and anticipate receiving an equity stake in the company in return for their investment.

Some firms may never conduct a Series A round of investment because the owners believe that a seed funding round is all that is required to properly launch their business. The majority of startups seeking seed capital have a value of between $3 million and $6 million. The average seed round pre-money valuation in 2020 was $6 million.

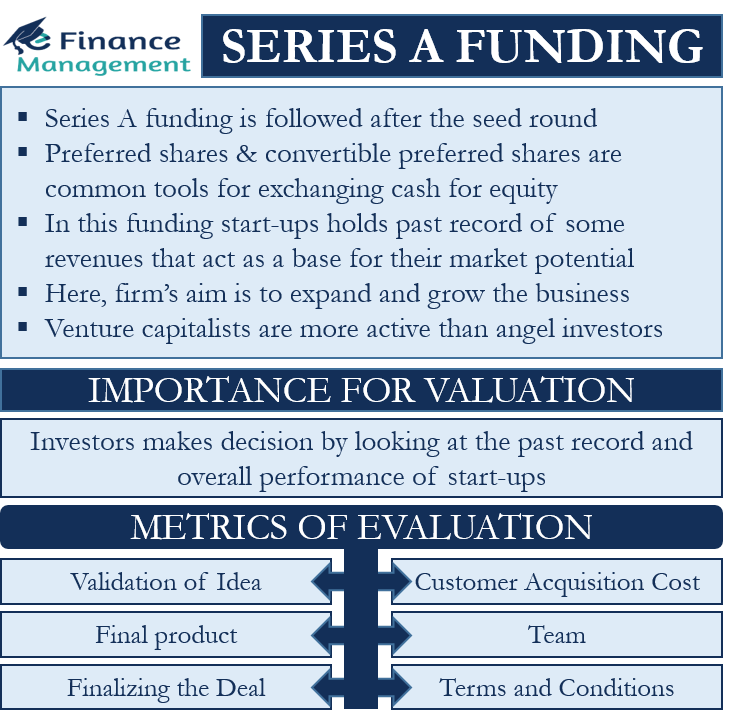

Series A

A company may choose Series A funding after establishing a track record (an established user base, consistent revenue statistics, or another important performance indicator) in order to further optimize its user base and product offerings. It may be possible to scale the product across many markets. Having a strategy for creating a business model that will yield long-term profit is crucial in this phase. Seed firms frequently have fantastic concepts that attract a sizable number of devoted users, but the company is unsure of how it will monetize the business. Series A rounds typically raise between $2 million to $15 million, however due to high tech industry valuations, or unicorns, this amount has generally increased.

Some firms may never conduct a Series A round of investment because the owners believe that a seed funding round is all that is required to properly launch their business. The majority of startups seeking seed capital have a value of between $3 million and $6 million. The average seed round pre-money valuation in 2020 was $6 million.

The Series A round’s investors are from better established venture capital firms. Sequoia Capital, IDG Capital, Google Ventures, and Intel Capital are well-known venture capital companies that take part in Series A investing.

Investor participation in a slightly more political process is also typical at this point. It’s normal for a few venture capital firms to lead the pack. In actuality, one investor may act as a “anchor.” Once a business has found its first investor, it can discover that finding more investors isn’t as difficult. At this point, angel investors also make investments, but they often have less of an impact than they did during the seed funding phase.

Equity crowdfunding is becoming a more popular method used by businesses to raise money as part of a Series A fundraising round. The fact that many businesses, including those that have successfully raised seed money, frequently struggle to elicit investor interest as part of a Series A funding campaign is one factor contributing to this. Less than 10% of seed-funded businesses will ultimately receive Series A funding as well.

Series B funding

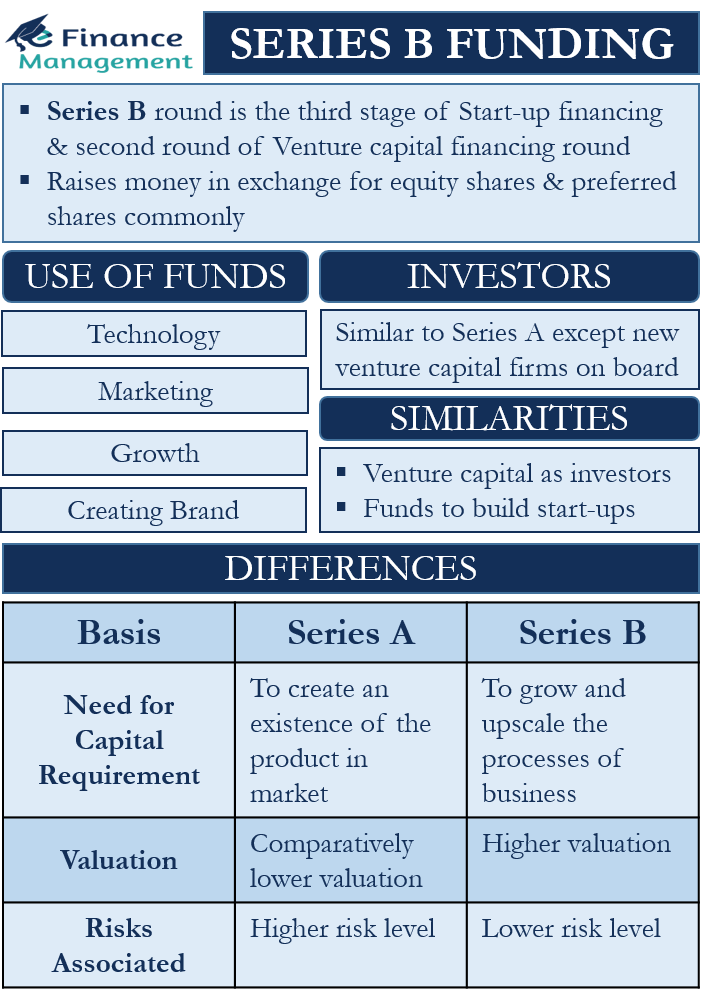

Series B rounds are all about moving businesses beyond the development stage and into the next phase. Startups are assisted by investors by their increased market reach. Companies that have undergone Series A and Seed fundraising rounds have established sizable user bases and shown investors that they are ready for success on a broader scale. The company will need Series B capital to expand in order to handle this level of demand.

Acquiring top talent is necessary for developing a winning product and a team. A company spends a few pennies to grow its customer base, sales, advertising, technology, support, and staff. A Series B round’s median projected capital raised in 2020 was $26 million. Companies undergoing a Series B investment round are typically well-established, and this is reflected in their valuations, which typically range from $30 million to $60 million. The pre-money valuation of Series B companies was $40 million on average in 2021.

In terms of the procedures and major players, Series B seems to be comparable to Series A. A key anchor investor who attracts other investors often leads Series B, which frequently features many of the same players as the first round. The addition of a fresh round of additional venture capital firms that focus on later-stage investing makes Series B different.

Series C funding

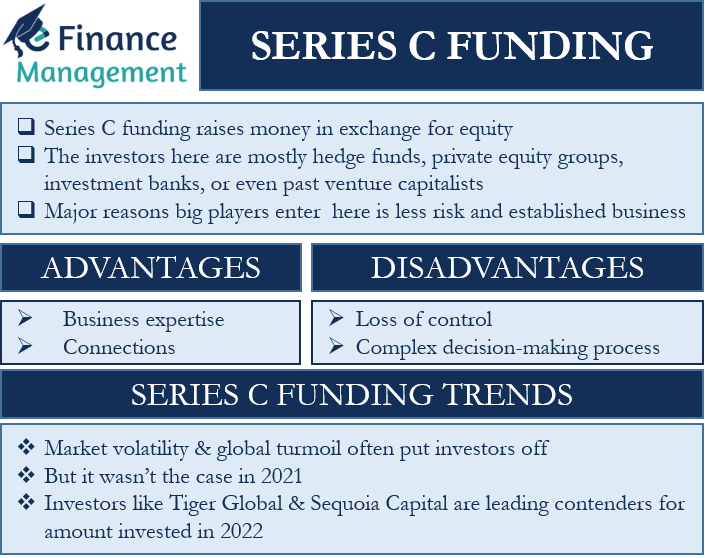

Businesses that advance to Series C investment rounds have already achieved considerable success. These businesses seek out additional money to aid in the creation of new products, market expansion, and even company acquisition. In Series C rounds, investors put money into the core of profitable companies in an effort to get back more than twice as much. Scaling the business and achieving the best possible growth are the main goals of the Series C fundraising.

A corporation will typically finish its outside equity fundraising with Series C. Some businesses, however, may go to Series D and even Series E rounds of capital. However, businesses who receive Series C round capital of up to hundreds of millions of dollars are typically ready to continue their global expansion. In order to increase their valuation in preparation for an IPO, many of these businesses use Series C capital. Companies currently enjoy higher valuations. The average pre-money valuation for Series C companies in 2021 was about $68 million, while some businesses seeking Series C capital may have substantially greater valuations.

Additionally, rather than being based on predictions of future success, these values are increasingly based on actual data. Companies seeking Series C capital must to have well-established, reliable revenue streams, solid client bases, and histories of expansion.

Companies that do pursue Series D capital typically do so for one of two reasons: either they need one last boost before going public, or else they haven’t yet succeeded in meeting the objectives they established during Series C funding.

Bottom Line

You may better interpret startup news and assess the chances of entrepreneurship by being aware of the differences between various capital-raising stages. The underlying principles of how the various rounds of funding work are the same: investors give money in exchange for an equity stake in the company. Investors place slightly different demands on the firm between rounds.

Each case study’s company profiles are unique, however they often have various risk profiles and maturity levels depending on the funding stage. But both seed investors and Series A, B, and C investors support the development of ideas. Through series investment, investors can provide entrepreneurs with the resources they need to realize their goals, with the possibility of making money jointly in the future through an IPO.