- Loan for needs and never for luxury

Even though things have changed dramatically over time and getting a personal loan is no longer difficult, it still makes no sense to borrow money without hesitation.

As a result, you should only borrow the amount you need and not a cent more. If your credit limit is large, you may believe you can borrow more than you need since you have the luxury of doing so, but this may make repayment of the loan more difficult in the future.

EMIs are directly proportional to the loan amount taken, and borrowing funds according to your needs is the greatest method to keep them to a minimum.

2. Being on time is the respect you give towards your commitments

Ensure that your loan payments are made on time.

The benefit of using fixed EMIs as a loan repayment arrangement is that you may spread out the repayment of the loan amount over several months, reducing the strain of repayment. It will reflect on your credit report if you fail to pay even a single EMI.

You will not only be burdened for the next month’s EMI repayment, but you will also be responsible for the penalty associated with late EMI repayment. Your credit history, as well as your financial history, will degrade.

This means that taking out any type of loan in the future will be a nightmare. As your creditworthiness improves, lenders will typically offer lower interest rates on future loans if you pay all of your EMIs on time.

3. Slow and steady wins the race

The overall length of time you have to pay back the principal and interest on a loan is referred to as the loan tenure. The monthly amount you pay might be greatly reduced if you choose a longer loan term. While this may appear to be a more advantageous alternative, the fact is that when you choose a longer loan term, you will end up paying significantly more in interest than if you choose a shorter loan term.

As a result, it is strongly advised that you calculate your monthly expenses and determine the best EMI for the shortest loan term possible. You will be able to return the entire loan amount sooner and save money by paying lower interest.

4. Prevention is better than cure

A loan protection insurance policy might be quite useful if you are taking out a large loan. This manner, you or your family members will not bear the pain of a missed EMI payment for a given month. Loan protection insurances are designed to assist borrowers in the event of significant accidents, job loss, disability, or death.

In such instances, if the borrower fails to pay the loan’s EMI, the loan protection insurance business is responsible for paying off the remaining EMIs for the borrowed amount. As a result, if you’re looking for a large loan, don’t forget to purchase a protection plan as well.

5. Select right to calm the storm

Choose the most suitable option.

In the last few years, a slew of new companies have entered the market to provide unsecured personal loans. In order to entice customers, companies now offer cheaper interest rates and other attractive features.

So, if you decide to take out a personal loan, make sure to shop around for all of your possibilities before deciding.

These days, thanks to the internet, this comparison is simple to do. Compare the interest rates, EMIs, and other fees offered by each lender. Before applying for a loan, it is vital that you conduct a thorough and complete comparison of different lenders.

6. Keep an eye on the details

Customers are charged hidden costs in addition to the EMI by a number of financial institutions and lenders. The majority of these are nicely tucked away in a lengthy loan agreement that the majority of clients never read.

If you want to avoid paying a large unexpected cost, you should be totally aware of all additional charges, such as processing fees, late EMI penalties, or foreclosure charges, for example. Each lender will have their own set of terms and conditions that will be listed in the loan agreement that you will be asked to sign when applying for a loan.

Before signing this loan agreement, make sure to read it attentively because it contains significant lending policies and charges. This will ensure that you do not have to pay any unexpected fees, which would raise the amount you return and, as a result, your EMI.

7. Recheck and Revise

EMI should be re-evaluated every year

When it comes to EMI repayment of the borrowed amount, each lender has their own set of rules and restrictions. Many lenders allow borrowers to adjust their EMI payments year after year. Take advantage of this policy by renewing the EMI payment on an annual basis in accordance with your annual budget.

For example, if your monthly income unexpectedly increases or increases on a steady basis, you can complete the necessary calculations and increase the EMI amount to repay the loan faster. As a general rule, increase your EMI payout by 5% for every 10% rise in your monthly income.

Although the monthly reshuffling of EMIs may appear inconvenient, it can considerably lower the length of your loan and allow you to pay off the debt sooner.

8. Pay in advance, whenever possible

If you acquire a windfall from an investment, family, or your job, use it to pay off the loan, or at least a portion of it, even if it means paying a modest foreclosure fee. When you prepay a portion of your personal loan, you can avoid paying interest on the borrowed amount, which you would have paid otherwise during the loan term.

You will be able to pay off the borrowed loan amount faster and become debt-free sooner this way. This is especially true if there are a lot of EMIs left.

9. Streamline Your Debts by Consolidating Your Debts

It’s possible that you’ll be obliged to borrow from a variety of sources in order to meet your capital needs. Private moneylenders frequently charge high interest rates. This can make paying many EMIs on time and keeping track of various lenders’ outstanding loan amounts difficult. You’re also more likely to default on at least one of your loans as a result of this.

When you’re in a scenario like this, your credit score can suffer, which can make it difficult for you to get a loan in the future. If you wish to consolidate all of your existing loans, though, you should take out a second personal loan.

This will not only help you better manage your debt and EMIs, but it will also help you pay off your debt faster and save money on your EMIs.

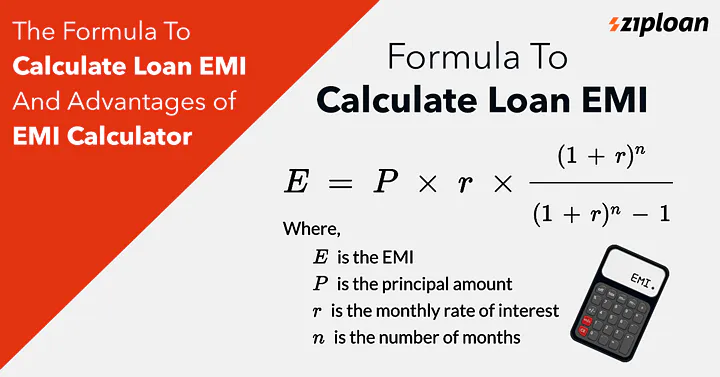

10. Calculate the EMI with care before Taking Out a Personal Loan

There are various simple EMI calculators accessible on a variety of platforms these days to assist you in calculating the EMI for your desired loan amount and tenure. You may receive a clear image of the EMI you’ll have to pay based on the loan amount and term with only a few clicks. When you do this calculation ahead of time, you’ll have a better idea of how you’ll need to adapt your budget and whether or not the EMI will affect your monthly expenses.

Simply enter the loan amount and alter the loan tenure or EMI to see all of the repayment options and choose the one that best matches your needs.

When it comes to qualifying for a personal loan, following these guidelines might help you make better selections. You will be able to close the loan quickly and pay lesser EMIs if you make well-informed and wise financial selections. Remember that if you take out a personal loan for a larger amount than you need, you will unintentionally wind up paying more EMI each month.

So, carefully consider the loan amount, choose the best lender, do some math, and make sure you understand what you’re signing up for. You can keep your personal loans from becoming a liability and preserve a strong credit record by keeping your EMIs as low as feasible.