Micro, small, and medium enterprises, or MSMEs, are the foundation of any developing economy. The MSMED Act was created by the Indian government to encourage and promote MSMEs through different subsidies, programmes, and incentives. Udyog Aadhar or MSME Registration is required to receive benefits under the MSMED Act from the Central or State Governments, as well as the Banking Sector.

The Central Government, hereby notifies the following criteria for classification of micro, small and medium enterprises, namely:—

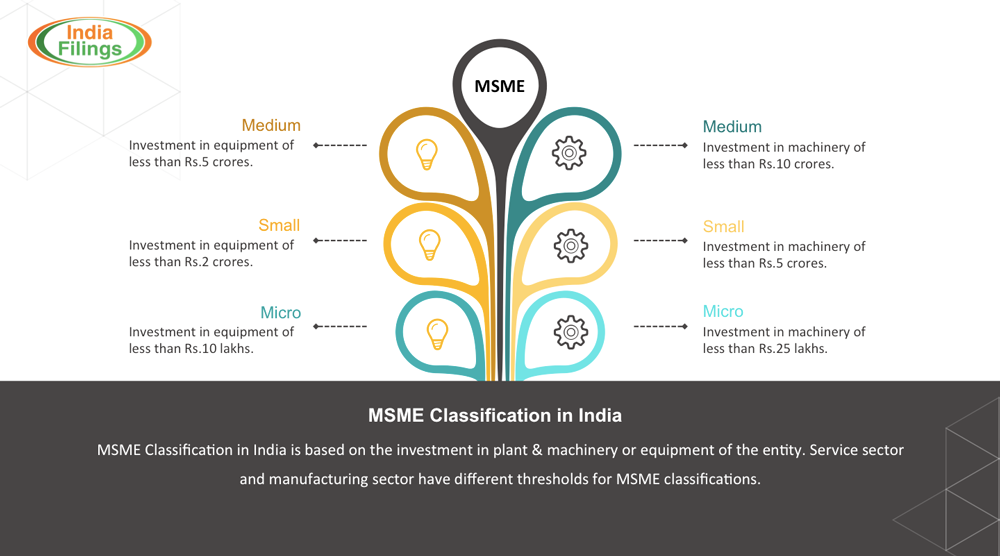

(i) A micro enterprise, where the investment in Plant and Machinery or Equipment does not exceed one crore rupees and turnover does not exceed five crore rupees;

(ii) A small enterprise, where the investment in Plant and Machinery or Equipment does not exceed ten crore rupees and turnover does not exceed fifty crore rupees;

(iii) A medium enterprise, where the investment in Plant and Machinery or Equipment does not exceed fifty crore rupees and turnover does not exceed two hundred and fifty crore rupees.

How to register?

MSME registration is under the UDYAM registration, and by this initiative, the ministry hopes to attract more such start-ups and businesses. This allows the opportunity to vouch for a few MSME government benefits.

The registration will require the business head or entrepreneur to submit a few documents like

- Aadhar card

- PAN card

- Number of employees

- Place of organization

- Investment turnover per year

Also Read: More than a bulb: the story of Thomas Edison

Post Registration

The company’s registration is advantageous in many aspects of the business. They are now eligible for special incentives under the MSME Development Act. The central, state, and union territory governments have created special packages and perks under schemes aimed at encouraging these businesses to expand and contribute more to the economy.

Key Benefits

1. Bank Loans (Collateral Free)

The Government of India has made collateral-free credit available to all small and micro-business sectors. This initiative guarantees funds to micro and small sector enterprises. Under this scheme, both the old as well as the new enterprises can claim the benefits. A trust named The Credit Guarantee Trust Fund Scheme was introduced by the Government Of India, SIDBI(Small Industries Development Bank Of India) and the Ministry of Micro, Small and Medium Enterprise to make sure this scheme is implemented (Credit Guarantee Scheme) for all Micro and Small Enterprises.

2. Subsidy on Patent Registration

Under the current laws, MSMEs registered with the MSME ministry stand to benefit from a 50% subsidy on their patent registration fees. This encourages small businesses and firms to keep innovating and working on new projects and technologies. The subsidy can be availed by submitting an application to the respective ministries.

3. Overdraft Interest Rate Exemption

Businesses and enterprises registered as MSMEs can avail a benefit of 1% on the OverDraft in a scheme that differs from bank to bank. This helps to make small businesses secure during unfavorable markets.

4. Industrial Promotion Subsidy Eligibility

Businesses that have been registered as MSMEs are eligible for subsidies for Industrial Promotion as provided by the Government.

5. Protection against Payments (Delayed Payments)

MSMEs constantly face the risk of delayed payments which in turn disturbs their entire business. In order to protect registered companies, the Supreme Court has mandated that any buyer of goods or services from registered MSMEs is required to make the payment on or before the agreed date of payment or within 15 days from the day they had accepted the goods or services. If the buyer delays the payment for more than 45 days after accepting the products or services then the buyer has to pay interest on the amount that was agreed to be paid. The interest rate is three times the rate that is notified by the Reserve Bank of India.

6. ISO Certification Charges Reimbursement

Any registered micro, small and medium enterprise can claim reimbursement of the expenses that were made in order to obtain an ISO certification. This motivates entrepreneurs to get their respective businesses ISO certified which helps them to do business abroad in terms of high-quality exports.

7. Concessions on Electricity Bills

All companies that have the MSME Registration Certificate are entitled to concessions on their electric bill. This enables businesses to boost production and take in more orders without worrying about capital expenditure on costs like electricity and maintenance. micro, small and medium enterprises can avail of the concession by providing an application to the department of electricity along with the certificate of registration. (Source : MSMEX)

Further Readings