Given the disparities between rich and poor in India, rising inflation is a major source of concern. Prices rise as a result of a surplus of money in relation to the goods and services produced. The Reserve Bank of India has a number of responsibilities, one of which is “Price Control.”

The Reserve Bank of India is in charge of controlling inflation through monetary policies, which include raising bank rates, repo rates, cash reserve ratios, dollar purchases, and managing money supply and credit availability. These actions diminish the money supply in the market, lowering demand and, as a result, lowering prices. However, the inefficiency of these technologies is stifling growth and investment patterns.

Though challenging, the Reserve Bank of India can impose certain regulations to direct funding toward infrastructure improvements rather than artificially lowering demand.

Introduction

Rural India is home to more than 60% of the Indian population. As a result, the rise in the price of essential commodities has a direct impact on the poor and middle classes. When prices rise or the value of money falls, certain groups benefit, while others suffer losses. To stabilize prices and minimize inflationary impacts that directly affect both producers and consumers, it is necessary to understand inflation, its sources, effects, and ways for dealing with it. The Reserve Bank of India (RBI) has implemented several monetary policies in order to control such financial crises. It is also examined how these instruments aid in the fight against inflation, their effectiveness, and what other measures could be used to help monetary policy achieve its goal.

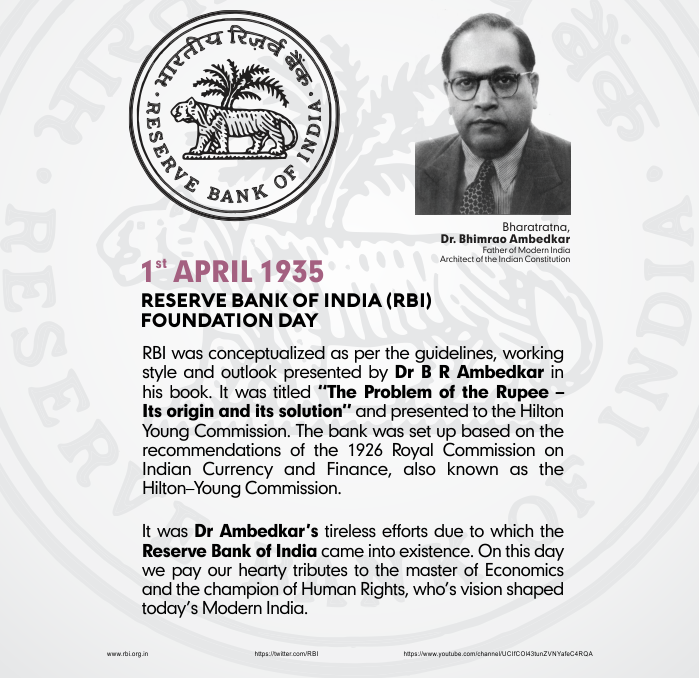

Reserve Bank of India

The Reserve Bank of India, sometimes known as the Banker’s Bank or the Lender of Last Resort, is India’s central banking institution, in charge of the country’s monetary policy and financial sector. The Reserve Bank of India (RBI) was created on April 1, 1935, by the British council under the provisions of the Reserve Bank of India Act, 1934. The Reserve Bank of India’s main branch was originally located in Calcutta, but in 1937 it was relocated to Mumbai. Following India’s independence in 1949, the Reserve Bank of India (RBI) was nationalized, and it is currently completely controlled by the Indian government.

The RBI’s goals are outlined in the Preamble as “…to regulate the issue of Bank Notes and the holding of reserves with a view to securing monetary stability in India and generally to administer the country’s currency and credit system to its advantage.”

India has one of the world’s largest constitutions, and maintaining and stabilizing the financial sector while maintaining social fairness is extremely tough. As a result, the RBI’s functions are difficult to comprehend and use in the actual world.

What can RBI do?

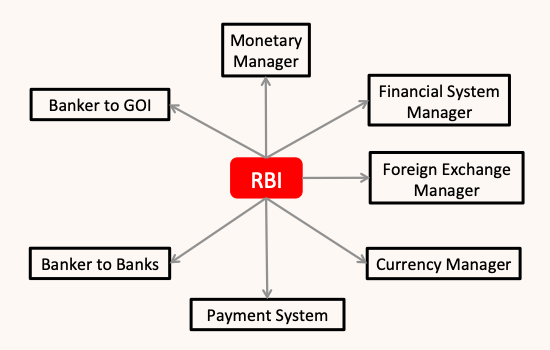

As a Banker’s Banker and Lender of Last Resort, the RBI serves as a bulwark for the country’s financial system. The Central Bank of India is responsible for Promotional and Development efforts in addition to its conventional tasks. The central bank’s mission and functions are critical for economic progress and stability in any growing country. RBI is responsible for a wide range of tasks, including banking system regulation and government debt management. Price stability, credit control, currency issuance, management of the Foreign Reserve, and money supply management in the financial sector are only a few of them. The RBI regulates commercial and public banks and encourages banking in the country’s rural areas. The RBI’s Monetary Policy is responsible for managing India’s entire financial system. As a result, the RBI’s involvement in the development and stability of the Indian financial system is critical.

Inflation

Inflation is commonly misunderstood as just “price increases.” There may be transitory price changes due to temporary events such as a sudden bumper or unexpected failure in output in particular areas such as agriculture. These pricing changes must not be interpreted as a trend.

However, neither inflation or deflation are anything more than market fluctuations in supply. Inflation is a multidimensional economic term that is far more difficult to handle.

As Kaushik Basu, the Ministry of Finance’s Chief Economic Advisor, states,

“Inflation has little to do with these changes in relative prices of goods and services (though inflation may play a role),”

Instead, it refers to a prolonged rise in prices across the board, i.e., a phenomena in which the average price of all goods has been rising for some time.”

The mismatch between total supply and total demand, as well as the policy framework and implementation, is what causes inflation. The aggregate demand in an economy is influenced by a variety of factors, including the industrial and agricultural sectors, corporations, laborers, households, and government. As a result, the amount of influence that any single source has is limited. Due to their interconnected structure, it’s also difficult to figure out exactly which source is causing what and to what extent it’s hurting the economy.

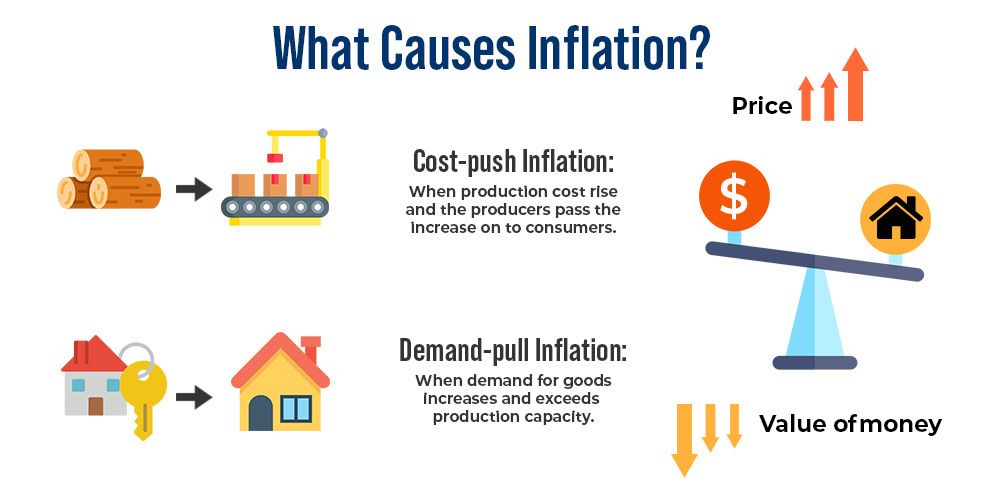

What causes Inflation?

Demand is said to be one of the key elements contributing to inflation. When the market’s supply cannot keep up with the demand, demand-pull inflation occurs. Many variables can cause demand to rise, such as an increase in money supply and/or a large amount of government spending, which can lead to more disposable income. The supply flow has also been disrupted by an increase in rural income and a shift in consumption patterns. With its export-oriented policies and large investments, the private sector generates employment and high income. Government program such as deficit financing, which is used to reduce public debt, and Cheap Monetary Policy, which is used to expand credit, increase the money supply. As a result of these factors, an economy’s overall money supply grows.

Effects of Inflation

Inflation causes an unjustifiable transfer of wealth from the poor to the rich: the poor and middle class suffer from the fixed nature of their income even as prices rise, whilst industrialists, traders, and businesses benefit greatly from their variable revenue.

Inflation has a number of negative consequences, including a loss of purchasing power and a decrease in the real value of money. It also creates risk and uncertainty, particularly in terms of money’s future purchasing power, discouraging saves and investments. Taxpayers are forced to pay higher income tax rates due to fictitious inflated incomes. As inflation grows, speculation money rises with it, increasing hoarding and black-market trading. The economy becomes stuck in a wage-price spiral, in which one is both the source and the result of the other.

Inflation that is consistently high disrupts investment patterns, which has a detrimental impact on the economy.

How RBI tries to control the inflation rate?

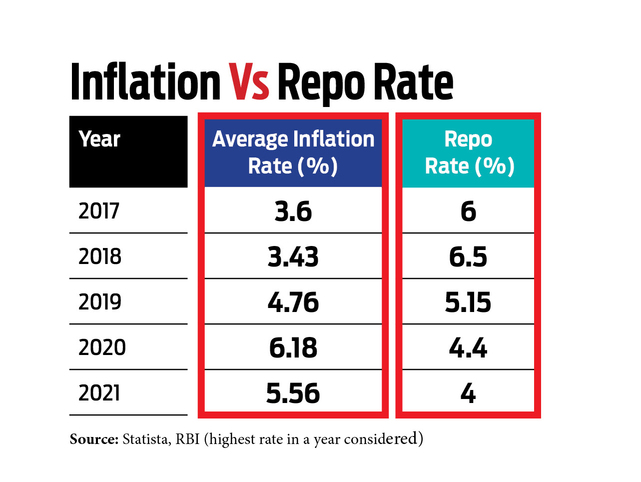

To keep inflation under control, the RBI has implemented policies that reduce or increase specific rates. As a result, it’s critical to comprehend these rates and how they effect inflation.

- Interest rates

(a) Repo Rate – The repo rate (Repurchase or Repossession) is the rate at which the RBI purchases government securities from commercial banks under a repossession arrangement. It is a short-term borrowing from the central bank secured by securities to inject money to bridge the gap between money demand (loans) and bank deposits.

(b) Reverse Repo rate -The rate at which the RBI borrows money from commercial banks is known as the reverse repo rate. When there are no other attractive options for investing short-term excess liquidity or when the market is uncertain for an extended period of time, banks deposit money in the RBI.

(c) Bank Rate– The bank rate is the rate at which the RBI authorizes domestic banks to borrow money. It is usually only for a brief time. There are no securities to be held against the finance, unlike a repo rate. Bank rates, on the other hand, are rarely changed in inflation-controlling measures.

Increases in these interest rates suggest the RBI is making it more expensive for commercial banks to borrow money (in the case of the reverse repo rate, it’s more profitable to hold deposits in the RBI), reducing the amount of money injected into the market. This is done by the RBI to reduce market liquidity.

Reserve Ratios

(a)Cash Reserve Ratio– To maintain the safety and liquidity of deposits, banks are required to hold a portion of deposit obligations in the form of liquid cash, or CRR, with the RBI.

(B) Statutory Liquidity Ratio– Every bank in India is required to keep a certain percentage of its net demand and time deposits in cash, gold, precious and semiprecious stones as liquid assets. Since the last 14 years, SLR has stayed practically constant.

When reserve ratios rise, the total amount of deposits held by commercial banks that can be used to make commercial loans falls, reducing the banks’ loan-granting capacity. This instrument is used by the RBI to restrict credit in the market.

Open Market Operations

The RBI has the authority to buy or sell government securities from or to the general public. To keep inflation under control, the RBI sells securities in the money market, sucking excess liquidity out of the market. Demand falls when the amount of liquid cash available declines. The open market operation is the name given to this aspect of monetary policy.

Selective Credit Control

The Banking Regulation Act gives the RBI the authority to selectively limit the amount and pattern of advances made by banks. The RBI has used selective credit control to keep inflation in check for goods that are in limited supply or are susceptible to price changes, including as food grains, vegetables, pulses, oilseeds, cotton, sugar, gur, khansari, and other mass-market items. As a result, the selective credit restriction policy aims to dissuade banks from making advances against certain vital items.

The Reserve Bank of India (RBI) utilizes monetary policy to fight inflation, and it has been tightening it religiously for the past fiscal year (a first in the Indian financial system’s history). According to surveys (from the RBI), monetary instruments have been effective in combating inflation.

Conclusion

Many economists believe that a certain level of inflation is required for growth to occur. Only after the rate of inflation reaches a certain level does there exist an inflation-growth trade-off. The task at hand is to meet his minimal necessary pace. The RBI is currently focusing solely on the demand side, attempting to limit demand in order to control inflation. In order to keep inflation under control, there needs to be a balance of attention on both the demand and supply sides, as well as appropriate monetary and fiscal policies.

The traditional approach of artificially pushing demand down by raising the policy rate (repo and reverse repo) is not the solution.

It is commonly acknowledged that controlling an economic phenomenon such as inflation is no easy task, especially in such a large, diverse, and complicated economy. The RBI, on the other hand, may be able to build a comprehensive approach to stabilizing the minimum necessary rate of inflation by combining traditional procedures with other premium options.