Capital budgeting is a process of analysing all pros and cons of any project in which an individual is going to invest. In capital budget we try to understand overall scenario of projects like

- How much capital one should invest

- Risk of fall

- What amount we get back if the project is successful

- What time what span of time one locks his money

After that, in the light of all calculations and analysis, one can take a fruitful decision and this entire procedure is termed as capital budgeting.

Capital budgeting is a task of high-risk capital and involve multi-level steps. Some important steps in procedure of capital budgeting are written below:

- Exploring the treasure: means where to do investment

- Decide how much capital should be invested

- In estimate all and cons of project

- Decide how much risk one can take

- Implementation

Capital budgeting method

This capital budgeting method will help us to determine the financial viability of capital investment over the life of the investment.

Here are some capital budgeting methods

Internal rate of return

In internal rate of return method, we use particular formula to determine capital and risk involved. This is done by hit and trial method and by software.

(When using this calculation, finance professionals should recognize that the measurement for the internal rate of return is similar to the net present value metric (another capital budgeting method); however, the internal rate of return is formulated to make the net present value of all cash flows in a project equal to zero. It is for this reason that companies shouldn’t rely solely on the internal rate of return calculation to project profitability of a project and should use it in conjunction with at least one other budgeting metric, like net present value.) Source

Net present value

The purpose of net present value is same as internal rate of return but the efficiency of net present value is considered a more, as compared to the internal rate of return but no companies solely rely on it because As accounting for unexpected expenses can be difficult when budgeting for capital investments, it is important to consider using payback period metrics and the internal rate of return as possible alternatives to net present value calculations when evaluating a project or investment. So, the corporate world use payback period matrices for capital budgeting.

Profitability Index

Profitability Index is basically a tool to define the relationship between the capital invested and the amount returned back if the project gets success in business world.

Profitability Index defines the ratio of present value to cash flow over early period of investment. As this ratio increases beyond 1.0, the proposed investment becomes more desirable to companies. When this ratio does not exceed 1.0, the investment should be deferred, as the project’s present value is less than the initial investment.

Accounting rate of return

Accounting rate of return is basically the profitable amount which will return back from a proposal venture. This is considered as the main factor to decide. The amount of investment as the main goal of corporative is to make money from money and accounting rate of return estimates the amount which the company would get if project becomes successful. Although it has two drawbacks; the first drawback is that it does not account for the time value of the money involved—meaning that future returns’ worth can be significantly less than the returns currently being taken in. A second issue with relying solely on the accounting rate of return in capital budgeting is the lack of acknowledgement of cash flows. In contrast to these drawbacks, the accounting rate of return is quite useful for providing a clear picture of a project’s potential profitability, satisfying a firm’s desire to have a clear idea of the expected return on investment. This method also acknowledges earnings after tax and depreciation, making it effective for benchmarking a firm’s current level of performance.

Also Read : What is a Credit Card?

Payback period

Payback period method is considered to be one of the relying method of capital budgeting when used with other methods.

Payback periods are an integral component of capital budgeting and should always be incorporated when analysing the value of projected investments and projects. Payback period is a tool used to decide the span of time required to earn the same amount that is the company is going to invest. Payback period gives an idea to the company for how much period of they are going to lock their particular cash flow.

Risk analysis in capital budgeting

No investment can remain untouched with risk making money from money is a risky task. One should have to bear the consequences of it. It doesn’t matter whether it is good or bad. In corporate world risk comes from different sources and circumstances here are the list of some of the risk:

- Project Specific Risk

- Company specific Risk

- Industry Specific Risk

- Market Risk

- Competition Risk

- Risk due to economic condition

- International Risk

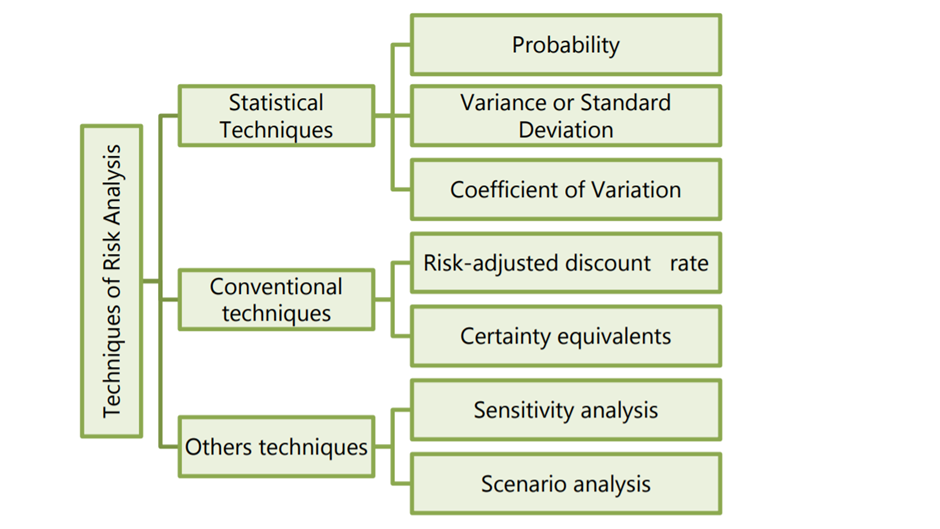

Statistical Techniques

The information needed for capital budgeting is generally not known with certainty. Therefore, capital-budgeting procedures under conditions of uncertainty should be developed to improve the precision of assessment of the value of risky investment projects. The three alternative methods are introduced to analyse the capital budgeting decisions under uncertainty. Statistical distribution methods, decision tree methods, and simulation methods are three interrelated methods of analysis for capital-budgeting decisions under uncertainty because all of them allow the statistical distributions of the net present values to be explicitly estimated. Under these methods, an interval rather than a point estimate of the expected NPV will be presented. Hence, the stochastic methods discussed in this paper are generally more objective and general than the traditional capital budgeting methods under the assumption of certainty in cash flows. (https://link.springer.com/)

Conventional Techniques

The traditional methods or non-discount methods include: Payback period and accounting rate of return method. The discounted cash flow method includes the NPV method, profitability index method and IRR.

Importance of capital budgeting corporate

Business world is a world of gambling money where everyone wants to take a calculated risk. Since, investment means the capital that we lock for span of time and after that particular span. It will be returned with a profitable amount. So, no investor wants to invest money in blind sources or project. Capital budget make investor to feel secure as it gives the idea about the risk, profit, span of time for which one can invest, pons and cons of project. For well-defined and efficient decisions. One should unturned all the stones related to capital and capital budgeting helps organizations and companies to play safe on a track of business races.

Further Reading: