The Directorate of Enforcement (ED), in its ongoing inquiry against leading cryptocurrency exchanges, has marked crypto exchange platforms which have not complied with the know-your-customer (KYC) regulations and anti-money laundering (AML) norms properly while facilitating transactions from other countries.

Apart from this, the probe reveals more…

The majority of investments made to these crypto exchanges as fundings from global VC firms still stand unregistered as they have not been filed under FC-GPR filing.

Additionally, these crypto exchanges used the wallet infra-structure of foreign crypto exchanges.

Hosting to a report from Business Standard, “ While the crypto exchanges received funds from global VC firms such as Tiger Global, Sequoia in the last three years, many of the investments have not been filed under the Reserve Bank of India ‘s (RBI) foreign currency-gross provisional return (FC-GPR) filing.”

A company is required to fill FC-GPR form with RBI for reporting the issue of eligible instruments to the overseas investor against any FDI inflow with an e-Biz portal of the Government of India.

Major exchanges like WzirX, CoinDCX, and CoinSwitch made money by facilitating foreign users’ requests to convert one cryptocurrency into another via third-party exchanges based in India.

While the crypto players are allowing crypto transactions without identification, one of the crypto players stated that it had only captured the internet protocol addresses of users during the investigation, according to a senior agency official quoted in the report.

As part of its investigation into alleged instances of foreign exchange violations, the agency sent notice to leading exchanges earlier this month and requested additional details and documents from crypto exchanges.

As per Inc42’s report, an official at a major crypto exchange told that it is not unusual for the exchanges to receive such notices as part of a routine investigation. Also, a CoinSwitch Kuber spokesperson said, “We receive queries from various government agencies. Our approach has always been that of transparency. Crypto is an early-stage industry with a lot of potential and we continuously engage with all stakeholders.”

Crypto Exchanges under Radar

Not only the ED but also the Income Tax Department and the GST Commissionerate are holding the neck of these Crypto Exchanges where the ED is reportedly inquiring about details on offshore transactions.

A year ago, WazirX officials were summoned by ED in line with crypto transactions worth 2800 Cr. Approx. The exchange platform alleged these were in violation of FEMA rules.

“The matter is pending before the Karnataka High Court where the company and its director filed a writ petition and the court has passed an interim order. We have complied with the order. The matter is subjudice. WazirX is not the only exchange to have received such a summon,” a WazirX spokesperson told Inc42 on the earlier investigation.

GST Commissionerate’s Probe reveals

In December 2021, the GST Commissionerate of Mumbai zone discovered INR 40.5 Cr in GST evasion by WazirX, India’s largest crypto exchange by trading volume. It had also recovered INR 49.20 Cr in cash for GST evasion, interest, and penalties.

“The firm is charging a commission on each transaction in cryptocurrency from buyer and seller both. However, the rate of commission is different for both the transactions. The transaction in rupee attracts the commission of 0.2% and transaction in WRX attracts the commission of 0.1%,” the Ministry of Finance said in a statement then.

It claimed that WazirX only paid GST on commissions earned in rupees, not commissions earned in WRX. The ministry also stated at the time that the CGST department would cover all cryptocurrency exchanges in the Mumbai zone and would intensify the drive in the coming days.

Later that month, in March 2022, Minister of State for Finance Pankaj Chaudhary informed Parliament that the government had recovered INR 95.86 Cr from 11 leading cryptocurrency exchanges in the country, including CoinDCX, WazirX, CoinSwitch Kuber, and Unocoin.

The Indian government has not yet stated its position on cryptocurrencies. While the industry anticipated that taxing cryptocurrency income and transactions would legalise it, Finance Minister Nirmala Sitharaman clarified that taxing cryptocurrency does not give it legal status.

Is Crypto Regulation still under cloudiness?

Yes, it is a grey area, to be precise.

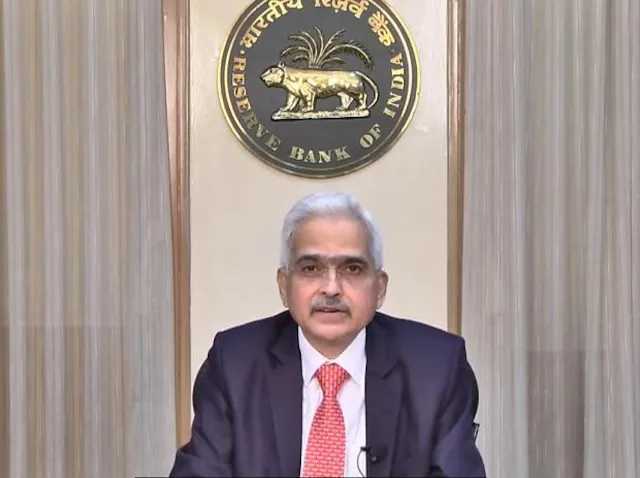

The Reserve Bank of India (RBI) has been vocal about its concerns about cryptocurrencies, repeatedly stating that they pose a threat to the Indian economy.

Recently, RBI Governor Shaktikanta Das referred to cryptocurrencies as a “clear danger.” Previously, top RBI officials told the Parliamentary Standing Committee on Finance that cryptocurrencies could be used to finance terrorism, launder money, and trafficking.

During Parliament’s Budget session, Chaudhary also stated that the government is aware of cybercriminals using cryptocurrency for money laundering.

“Reports have been received from Law Enforcement Agencies (LEAs) in connection with the usage of cryptocurrency by cybercriminals. The Directorate of Enforcement (ED) is investigating 07 cases under PMLA (Prevention of Money Laundering Act), 2002 in which cryptocurrency has been used for money laundering. Cases investigated by ED under PMLA, reveal that the accused have laundered Proceeds of Crime (PoC) through cryptocurrency,” he said.

Bottom-line

The global crises and economic slowdown have deeply affected cryptocurrencies’ prices. A sharp fall could be seen making a few crypto platforms suspend their operations. The blow from ED during such a harsh environment and regulatory challenge seems to be elevating the headaches of the crypto exchanges.