Non performing assets which are abbreviated as NPA refers to a classification for loans or advances that are in default or in arrears. Loan in default or loan in arrears are themselves differentiated in many ways.

A loan is said to be in arrears when the principal amount or interest payments are late or missed and a loan is in default when the lender considers the loan agreement to be broken and the debtor is unable to meet his obligations.

Non performing assets (NPAs) are recorded on a bank’s balance sheet after a prolonged period of non-payment by the borrower.

NPAs place financial burden on the lender; a significant number of NPAs over a period of time may indicate to regulators that the financial fitness of the bank is in jeopardy. NPAs can be classified as a substandard asset, doubtful asset, or loss asset, depending on the length of time overdue and probability of repayment.

Lenders have options to recover their losses, including taking possession of any collateral or selling off the loan at a significant discount to a collection agency.

Types of Non Performing Assets

Although the most common non performing assets are term loans, there are other forms of non performing assets as well.

- Overdraft and cash credit (OD/CC) accounts left out-of-order for more than 90 days

- Agricultural advances whose interest or principal installment payments remain overdue for two crop/harvest seasons for short duration crops or overdue one crop season for long duration crops

- Expected payment on any other type of account is overdue for more than 90 days

Working of Non performing Assets

Nonperforming assets are listed on the balance sheet of a bank or other financial institution. After a prolonged period of non-payment, the lender will force the borrower to liquidate any assets that were pledged as part of the debt agreement. If no assets were pledged, the lender might write-off the asset as a bad debt and then sell it at a discount to a collection agency.

In most cases, debt is classified as nonperforming when loan payments have not been made for a period of 90 days. While 90 days is the standard, the amount of elapsed time may be shorter or longer depending on the terms and conditions of each individual loan. A loan can be classified as a non performing asset at any point during the term of the loan or at its maturity.

Recording of Non Performing Assets

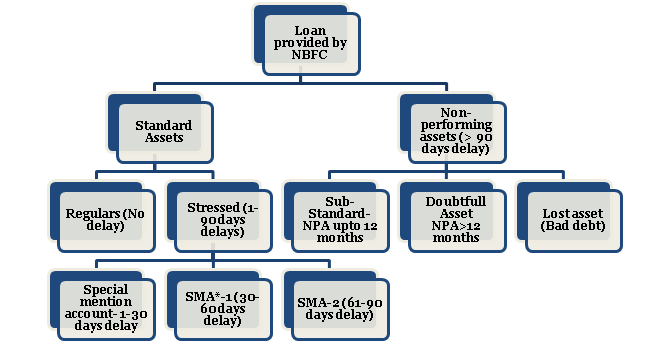

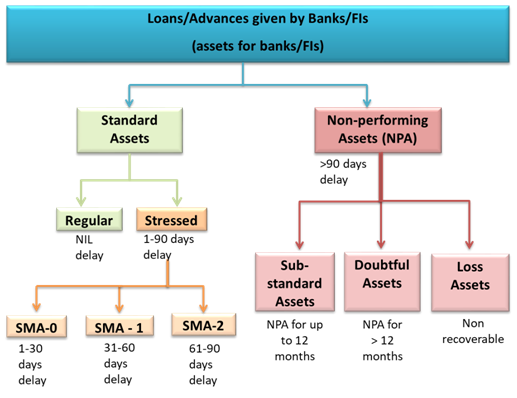

Banks are required to classify NPAs into one of three categories according to how long the asset has been nonperforming: sub-standard assets, doubtful assets, and loss assets.

A substandard asset is an asset classified as an NPA for less than 12 months. A doubtful asset is an asset that has been non performing for more than 12 months. Loss assets are loans with losses identified by the bank, auditor, or inspector that need to be fully written off. They typically have an extended period of non-payment, and it can be reasonably assumed that it will not be repaid.

Classification of Non performing assets

Lenders usually provide a grace period before classifying an asset as non-performing. Afterward, the lender or bank will categorize the NPA into one of the following sub-categories:

1. Standard Assets

They are NPAs that have been past due for anywhere from 90 days to 12 months, with a normal risk level.

2. Sub-Standard Assets

They are NPAs that have been past due for more than 12 months. They have a significantly higher risk level, combined with a borrower that has less than ideal credit. Banks usually assign a haircut (reduction in market value) to such NPAs because they are less certain that the borrower will eventually repay the full amount.

3. Doubtful Debts

Non-performing assets in the doubtful debts category have been past due for at least 18 months. Banks generally have serious doubts that the borrower will ever repay the full loan. This class of NPA seriously affects the bank’s own risk profile.

4. Loss Assets

These are non-performing assets with an extended period of non-payment. With this class, banks are forced to accept that the loan will never be repaid, and must record a loss on their balance sheet. The entire amount of the loan must be written off completely.

Significance of Non performing Assets

It is important for both the borrower and the lender to be aware of performing versus non-performing assets. For the borrower, if the asset is non-performing and interest payments are not made, it can negatively affect their credit and growth possibilities. It will then hamper their ability to obtain future borrowing.

For the bank or lender, interest earned on loans acts as a main source of income. Therefore, non-performing assets will negatively affect their ability to generate adequate income and thus, their overall profitability. It is important for banks to keep track of their non-performing assets because too many NPAs will adversely affect their liquidity and growth abilities.

Non-performing assets can be manageable, but it depends on how many there are and how far they are past due. In the short term, most banks can take on a fair amount of NPAs. However, if the volume of NPAs continues to build over a period of time, it threatens the financial health and future success of the lender.

Non performing assets in Indian Banks

According to the Reserve Bank of India (RBI), the gross non-performing assets in Indian banks, specifically in public sector banks, are valued at around Rs 400,000 crore (~US$61.5 billion), which represents 90% of the total NPA in India, with private sector banks accounting for the remainder.

Reasons for Rise in Non performing assets

From 2000-2008, the Indian economy was in a boom phase and banks, especially public sector banks, started lending extensively to companies.

However, with the financial crisis in 2008-09, corporate profits decreased and the Government banned mining = projects. The situation became serious with the substantial delay in environmental permits, affecting the infrastructure sector – power, iron, and steel – resulting in volatility in prices of raw materials and a shortage of supply.

Another reason is the relaxed lending norms adopted by banks, especially to the big corporate houses, foregoing analysis of their financials and credit ratings.