According to the Financial Times story, Softbank founder Masayoshi Son has directed his senior executives to slow down investments. What is the reason behind the Japanese conglomerate’s decision? Will it have an impact on India’s startup ecosystem?

According to the Financial Times, the world’s largest tech investor is trying to raise capital due to dropping tech stocks and a regulatory crackdown in China, both of which have had a negative impact on the SoftBank Group’s assets. According to the article, the expected write-down at the Japanese corporation for this quarter was $30 billion, albeit a recent increase in some shares reduced it to roughly $20 billion.

SoftBank, through its Vision Fund investment module, is one of the biggest investors in India’s start-up and consumer internet ecosystem, alongside the likes of Sequoia Capital and Tiger Global. In December, Son, speaking at India’s flagship global financial technology summit Infinity Forum, had said: “Just this year alone, we have invested $3 billion in India. We are the biggest foreign investor in the country. We are providers of about 10 per cent of the funding of all the unicorns — firms valued at $1 billion or more — in India.” He also claimed that SoftBank-backed companies in India have created more than 1 million jobs.

Also Read : India’s Warren Buffet – Mr. Rakesh Jhunjhunwala

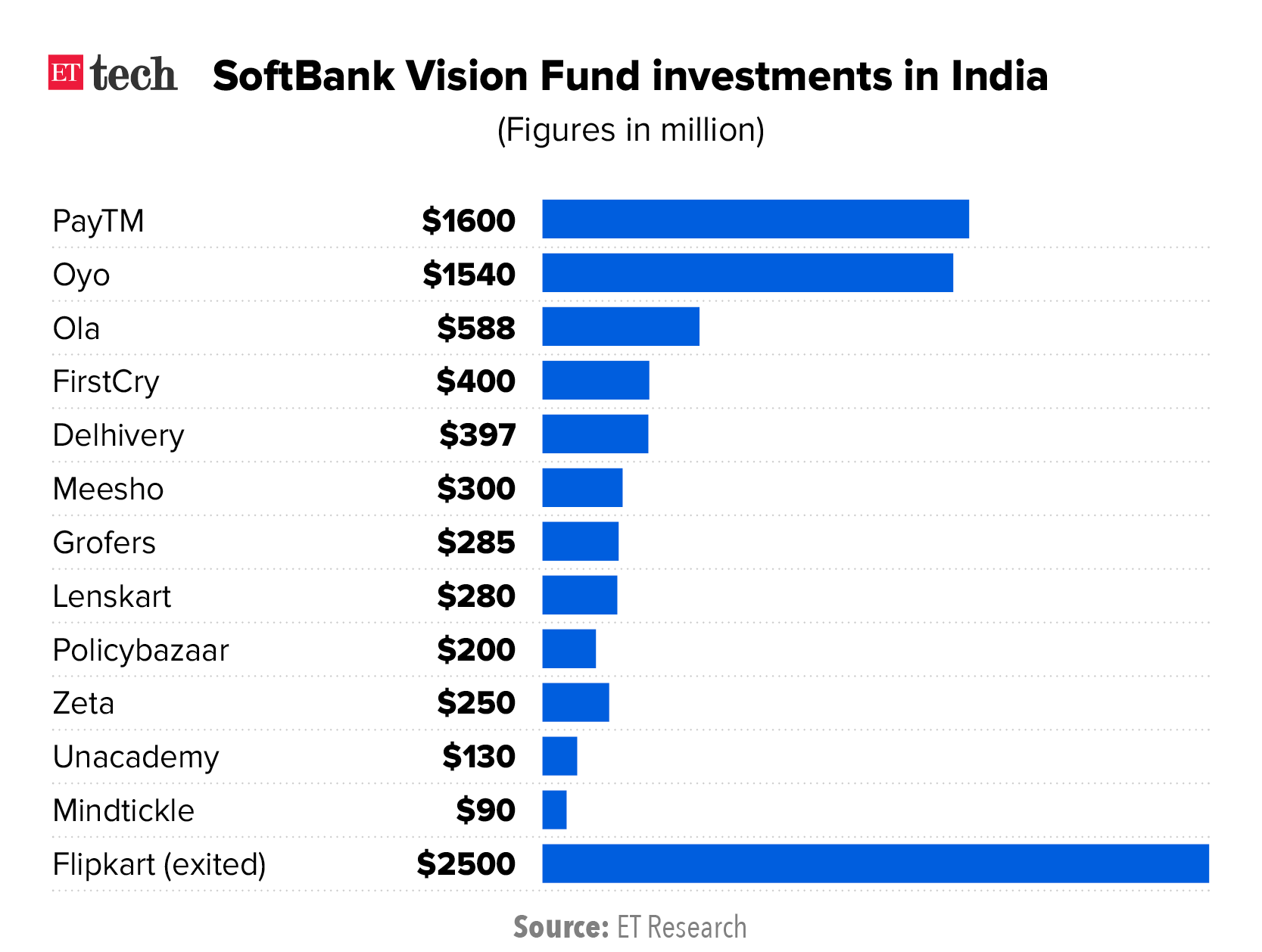

Companies backed by SoftBank in India

The Japanese conglomerate has backed some of the biggest names in the Indian tech industry, including Paytm, Flipkart, Ola, Oyo, Swiggy, Delhivery, InMobi, and Lenskart to name a few. Lately, it has also invested in companies such as Zeta, Meesho, OfBusiness, and turned them into unicorns.

Given that SoftBank is a major participant in India’s investment sector, the rumoured slowdown may cause some start-ups to reconsider their ambitious plans. However, the impact could be reduced on a larger scale as a result of other funds expediting their investments.

For example, Tiger Global has raised more than $11 billion for its current growth-investment fund, which it intends to employ in the United States, India, and China. Accel India, one of Flipkart’s early supporters, has raised $650 million for its seventh fund, which would invest in fresh prospects in India and Southeast Asia. According to reports, Sequoia Capital India is trying to raise $2.8 billion to invest in Indian and Southeast Asian firms.

About SoftBank

SoftBank Group Corp. is a Japanese multinational conglomerate holding corporation that specialises on investment management and is located in Minato, Tokyo.

The majority of the Group’s investments are in the technology, energy, and financial industries. With over $100 billion in resources, it also manages the Vision Fund, the world’s largest technology-focused venture capital fund. Sovereign wealth funds from the Middle East are among the fund’s investors.

Masayoshi Son, the company’s founder and main stakeholder, is well-known for his leadership. Broadband, fixed-line telecommunications, e-commerce, information technology, finance, media and marketing, and other fields are all areas in which it works. SoftBank Corporation, the company’s former flagship and spun-off affiliate, is Japan’s third-largest wireless carrier, with 45.621 million users as of March 2021.

SoftBank is the world’s 36th largest public business, and Japan’s second-largest publicly traded company after Toyota, according to the 2017 Forbes Global 2000 list.

Foundation

SoftBank was founded in September 1981 as a SOFTBANK Corp by then-24-year-old Masayoshi Son, initially as a software distributor. The company entered the publishing business in May 1982 with the launches of the Oh! PC and Oh! MZ magazines, about NEC and Sharp computers respectively. Oh!PC had a circulation of 140,000 copies by 1989. It would go on to become Japan’s largest publisher of computer and technology magazines and trade shows.

In 1994, the company went public, valued at $3 billion. In September 1995, SoftBank agreed to purchase US-based Ziff Davis publishing for $2.1 billion.

Further Readings